Understanding Market Trends: Exploring the Dynamics of Sensex and Nifty.

2 min read 2024-04-01, 04:00 PM IST

SummarySensex and Nifty serve as pivotal indices reflecting market sentiment and economic performance. Market capitalization determines the total value of listed companies’ outstanding shares. Recent trends show a significant surge in market capitalization, surpassing ₹294 lakh crore. Inflation, historically exceeding 7%, poses challenges to economic stability, prompting regulatory interventions. Central banks adopt prudent monetary policies, including repo rate adjustments, to maintain price stability and foster economic growth. Interest rates influence market dynamics and investor behavior, with lower rates stimulating economic activity. Recent reduction in the repo rate by the RBI reflects proactive measures to foster conducive monetary conditions. Educational initiatives empower aspirants with relevant knowledge and skills for competitive exams like UPSC, contributing to a resilient workforce. |

Nifty 50

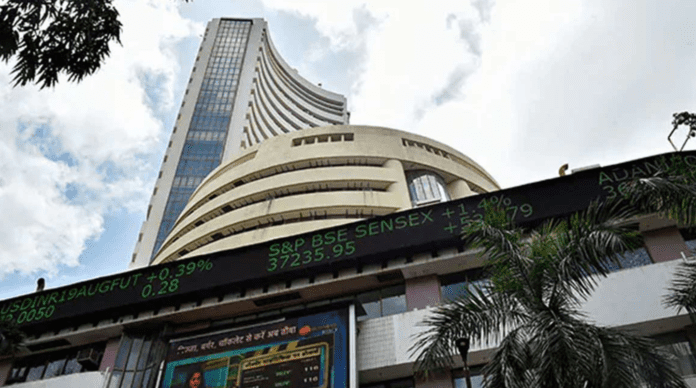

The stock market, often regarded as a barometer of economic health, exerts a significant influence on global financial landscapes. In this comprehensive analysis, we delve into the intricacies of two pivotal indices in the Indian stock market – the Sensex and Nifty. Moreover, we’ll explore the factors contributing to market movements, shedding light on market capitalization, inflation, and monetary policies.

Sensex and Nifty: Cornerstones of Indian Markets

The Sensex, comprising the top 30 companies listed on the Bombay Stock Exchange, serves as a crucial benchmark reflecting market sentiment and economic performance. Similarly, the Nifty index, representing 50 major companies on the National Stock Exchange, provides a broader perspective on market movements.

Market Capitalization: Unraveling the Core Metric

Market capitalization, a fundamental metric, determines the total value of a company’s outstanding shares. For instance, considering a hypothetical scenario where a company’s stock price is ₹500 and it has 1000 shares in circulation, the market capitalization would amount to ₹5,00,000. This metric encapsulates the collective worth of all listed companies, thereby influencing market dynamics.

Recent Trends in Market Capitalization

In recent times, the aggregate market capitalization of listed companies in the Indian stock exchanges has witnessed a significant surge, surpassing the ₹294 lakh crore mark. This uptrend signifies a robust growth trajectory, underlining investor confidence and economic vitality. Comparing this figure to past data, particularly in 2022, reveals a notable progression, signifying a buoyant market sentiment.

Inflation Dynamics: Impact on Market Sentiment

Inflation, a key economic indicator, plays a pivotal role in shaping market sentiment and policy decisions. Notably, retail inflation, representing consumer price trends, holds substantial significance in the financial realm. Historically, elevated inflation rates, exceeding 7%, have posed challenges to economic stability, prompting intervention from regulatory authorities.

Monetary Policy Implications

In response to prevailing inflationary pressures, central banks adopt prudent monetary policies aimed at maintaining price stability and fostering economic growth. The Reserve Bank of India (RBI), India’s central banking institution, orchestrates monetary policies through mechanisms such as the repo rate. In the past, escalating inflation rates necessitated a calibrated approach, leading to successive repo rate hikes.

New Global Update- your speediest source for breaking news! READ NOW →

Interest Rate Dynamics: Implications for Market Dynamics

Interest rates, intricately linked to monetary policies, exert a profound influence on market dynamics and investor behavior. Higher interest rates, indicative of tighter monetary conditions, often deter borrowing and investment activities, thereby constraining economic expansion. Conversely, lower interest rates stimulate economic activity by reducing borrowing costs and spurring consumer spending.

RBI’s Policy Initiatives: A Catalyst for Change

Against the backdrop of evolving economic dynamics, the RBI has embarked on a path of gradual interest rate normalization, aiming to strike a delicate balance between inflation containment and economic revival. The recent reduction in the repo rate, from 6.5% to 4.25%, underscores the central bank’s proactive stance in fostering conducive monetary conditions.

Market Outlook: Navigating Uncertain Terrain

As we navigate through the intricacies of market dynamics, it’s imperative to recognize the inherent volatility and uncertainty characterizing financial markets. While recent trends reflect optimism and resilience, unforeseen geopolitical events, economic shocks, or policy disruptions can potentially disrupt market equilibrium, underscoring the importance of risk management and strategic planning.

Educational Initiatives: Empowering Aspirants for Success

Amidst the evolving financial landscape, educational initiatives play a pivotal role in equipping aspiring professionals with the requisite knowledge and skills to navigate complex market dynamics. Platforms offering comprehensive courses and live sessions, tailored to competitive exams such as the UPSC, empower aspirants to achieve their academic and career aspirations.

The dynamic interplay of factors such as market capitalization, inflation, and monetary policies significantly influences stock market trends and investor sentiments. As we navigate through evolving economic landscapes, proactive policy interventions and informed decision-making are imperative to foster sustainable economic growth and financial stability. Moreover, educational initiatives aimed at empowering aspirants with relevant knowledge and skills contribute towards building a robust and resilient workforce, capable of thriving amidst uncertainty and challenges.