Navigating Turbulence: Examining the Financial Fallout and Uncertainties Surrounding Paytm’s Recent Stock Performance.

2 min read 2024-02-05, 09:55 PM IST

Summary

|

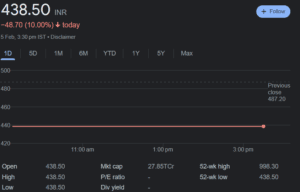

It seems like you’ve shared information about the recent developments in Paytm’s stock performance and the associated financial losses experienced by various investors, including promoters, funds, and retail investors. The company’s market cap has seen a significant decline, and there is concern about the impact on different stakeholders.

The decline in market value is attributed to lower circuits on consecutive days, wiping out a substantial portion of the market cap. Paytm’s stock has fallen below its issue price, leading to substantial losses for those who invested in the company.

Promoters have reportedly increased their holdings recently, only to see a significant decrease in the net worth of the promoters’ group. Retail investors and fund houses have also suffered considerable losses.

The financial performance of Paytm is discussed, highlighting its revenue and total losses over the past seven to eight years. The challenges faced by the company, such as client onboarding and retention issues in the competitive financial services sector, are also mentioned.

There is a mention of discussions around Paytm’s IPO listing and efforts to avoid potential pitfalls. The overall sentiment appears cautious, with a suggestion to avoid investing in Paytm at the moment, especially considering the recent lower circuits and the uncertainty surrounding the company’s future performance.

The conversation touches upon the role of RBI, and there seems to be uncertainty about the upcoming results by the 29th. The focus is on the significant volume in the lower circuits and the need to observe how the stock behaves in the coming days.

ALSO READ| Blue Jet Healthcare IPO.

It is suggested to approach the situation with caution, given the current challenges faced by Paytm and the uncertainties in the financial market. The narrative also references a post highlighting the courage of those still buying Paytm stock amid the challenging circumstances.